3 Easy Facts About Hsmb Advisory Llc Explained

3 Easy Facts About Hsmb Advisory Llc Explained

Blog Article

The 7-Second Trick For Hsmb Advisory Llc

Table of ContentsGetting My Hsmb Advisory Llc To WorkThe 10-Minute Rule for Hsmb Advisory LlcFacts About Hsmb Advisory Llc UncoveredUnknown Facts About Hsmb Advisory LlcAll About Hsmb Advisory LlcNot known Facts About Hsmb Advisory Llc

Ford says to avoid "money value or irreversible" life insurance policy, which is even more of a financial investment than an insurance policy. "Those are very made complex, featured high compensations, and 9 out of 10 people don't need them. They're oversold because insurance coverage representatives make the largest compensations on these," he claims.

Impairment insurance can be costly. And for those that choose for long-term care insurance policy, this plan might make impairment insurance policy unnecessary.

What Does Hsmb Advisory Llc Do?

If you have a persistent health and wellness worry, this sort of insurance coverage could end up being critical (St Petersburg, FL Life Insurance). Nevertheless, don't let it stress you or your financial institution account early in lifeit's usually best to get a plan in your 50s or 60s with the anticipation that you will not be utilizing it till your 70s or later on.

If you're a small-business owner, think about securing your livelihood by acquiring business insurance. In the event of a disaster-related closure or period of rebuilding, company insurance coverage can cover your earnings loss. Think about if a considerable weather condition occasion affected your shop or production facilityhow would that impact your earnings? And for the length of time? According to a report by FEMA, in between 4060% of tiny businesses never ever reopen their doors complying with a calamity.

And also, using insurance could sometimes set you back more than it conserves in the lengthy run. If you get a chip in your windshield, you may think about covering the repair cost with your emergency situation financial savings instead of your auto insurance. Life Insurance St Petersburg, FL.

The Of Hsmb Advisory Llc

Share these suggestions to shield enjoyed ones from being both underinsured and overinsuredand talk to a trusted specialist when required. (https://qn2zqpz6rch.typeform.com/to/btrlcl6T)

Insurance policy that is acquired by a specific for single-person coverage or protection of a household. The specific pays the premium, as opposed to employer-based health and wellness insurance where the employer frequently pays a share of the costs. Individuals might purchase and purchase insurance policy from any type of plans available in the person's geographic area.

Individuals and households may get approved for monetary support to lower the price of insurance premiums and out-of-pocket expenses, but only when enrolling through Attach for Health Colorado. If you experience specific adjustments in your life,, you are eligible for a 60-day period of time where you can register in a specific strategy, also if it is beyond the annual open enrollment period of Nov.

The Definitive Guide for Hsmb Advisory Llc

- Attach for Health And Wellness Colorado has a full checklist of these Qualifying Life Events. Dependent youngsters that are under age 26 are qualified to be consisted of as relative under a parent's protection.

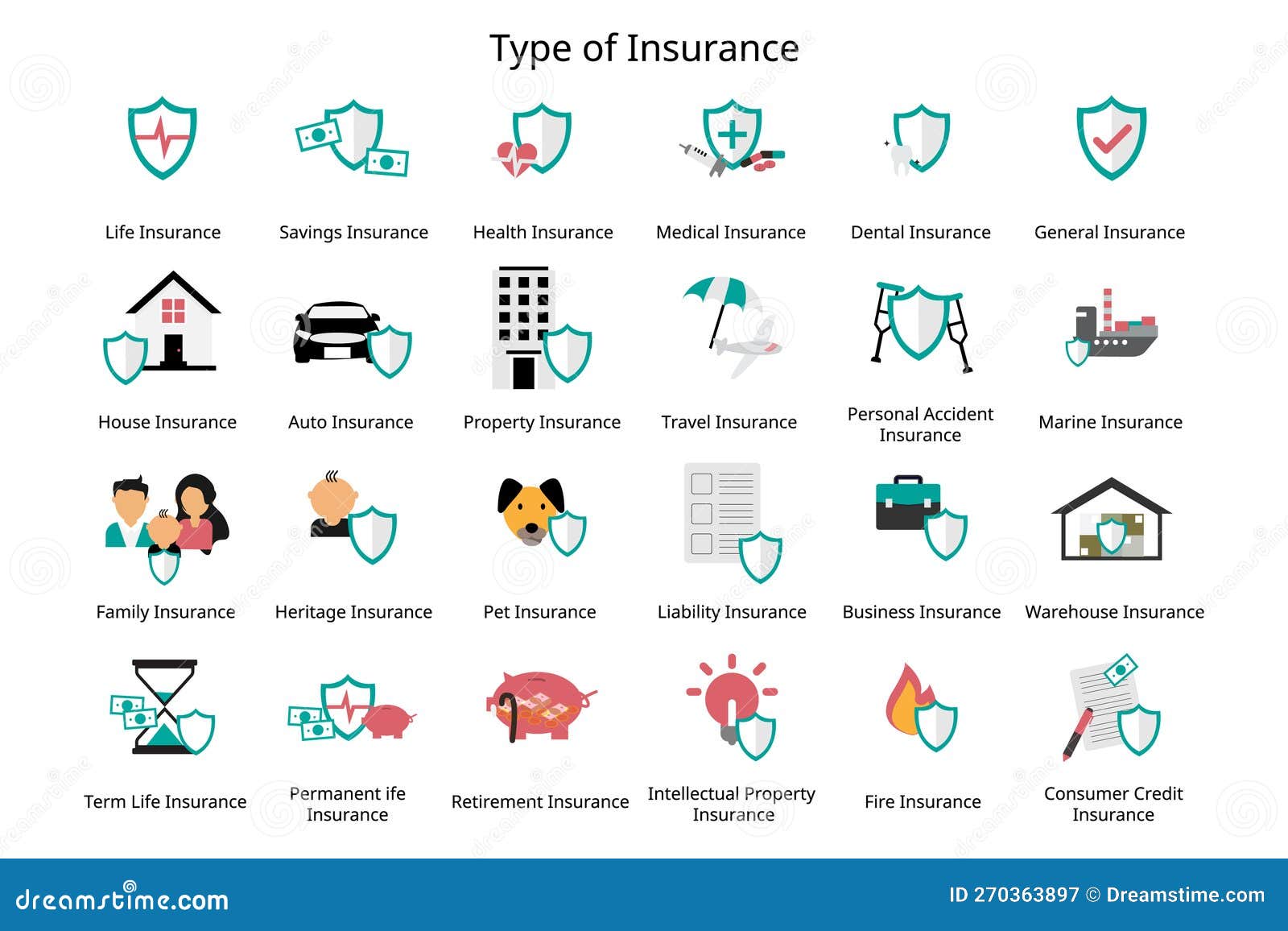

It may appear easy yet understanding insurance types can likewise be puzzling. Much of this confusion comes from the insurance policy industry's continuous objective to develop tailored coverage for insurance holders. In making adaptable plans, there are a range to pick fromand every one of those insurance coverage kinds can make it difficult to comprehend what a specific policy is and does.Hsmb Advisory Llc for Dummies

The best location to begin is to discuss the difference between both sorts of fundamental life insurance policy: term life insurance coverage and irreversible life insurance policy. Term life insurance policy is life insurance policy that is just energetic for a while period. If you die throughout this period, the person or people you have actually called as beneficiaries might obtain the cash payment of the policy.

Several term life insurance policies let you convert them to a whole life insurance coverage plan, so you do not lose insurance coverage. Commonly, term life insurance policy plan costs payments (what you pay per month or year right into your policy) are not locked in at the time of acquisition, so every 5 or 10 years you possess the plan, your costs might climb.

They additionally have a tendency to be cheaper total than whole life, unless you get a whole life insurance policy when you're young. There are likewise a few variations on term life insurance policy. One, called group term life insurance, prevails among insurance policy alternatives you may have accessibility to through your employer.The 2-Minute Rule for Hsmb Advisory Llc

One more variation that you may have accessibility to via your employer is supplementary life insurance policy., or burial insuranceadditional insurance coverage that could help your family in situation something unanticipated happens to you.

Permanent life insurance simply describes any life insurance policy plan that doesn't run out. There are a number of kinds of irreversible life insurancethe most usual kinds being entire life insurance Go Here coverage and universal life insurance coverage. Whole life insurance coverage is exactly what it seems like: life insurance policy for your whole life that pays out to your beneficiaries when you die.

Report this page